|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Filing Bankruptcy in Arkansas: A Comprehensive Guide

Filing for bankruptcy can be a daunting process, especially if you're unfamiliar with the specific regulations and steps involved in Arkansas. This guide aims to provide you with a clear understanding of what to expect and how to proceed.

Understanding Bankruptcy Types

In Arkansas, individuals typically file for bankruptcy under Chapter 7 or Chapter 13. Each type has different requirements and implications.

Chapter 7 Bankruptcy

Known as liquidation bankruptcy, Chapter 7 allows you to discharge most of your debts. It's suitable for those with limited income who cannot pay back their debts.

Chapter 13 Bankruptcy

This type is often referred to as a reorganization bankruptcy. It allows individuals with a regular income to create a repayment plan to pay back all or a portion of their debts over time.

The Bankruptcy Filing Process

The process of filing for bankruptcy in Arkansas involves several steps. Here's a breakdown:

- Credit Counseling: Before filing, you must complete a credit counseling course from an approved provider.

- Filing the Petition: Submit the bankruptcy petition, along with necessary documents, to the bankruptcy court.

- Automatic Stay: Once you file, an automatic stay goes into effect, halting most collection activities.

- 341 Meeting: Attend the meeting of creditors, where you'll answer questions about your financial situation.

- Discharge: If approved, the court will discharge qualifying debts, freeing you from liability.

For those considering an alternative approach, exploring emergency bankruptcy filing in Texas might offer a different perspective.

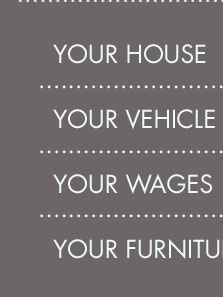

Assets and Exemptions

Understanding what assets you can keep is crucial when filing for bankruptcy in Arkansas.

- Homestead Exemption: Protects the equity in your home, up to a certain limit.

- Personal Property: Certain personal items like clothing and household goods may be exempt.

- Wages and Benefits: A portion of your wages and benefits can also be protected.

Life After Bankruptcy

Rebuilding your financial life after bankruptcy is possible and important. Focus on creating a budget, establishing an emergency fund, and gradually improving your credit score.

For those in other states, like filing bankruptcy under Chapter 13 in Michigan, the process may differ slightly but shares many similarities.

Frequently Asked Questions

What debts cannot be discharged in Arkansas?

Certain debts, such as child support, alimony, most student loans, and some taxes, cannot be discharged through bankruptcy.

How long does the bankruptcy process take?

The process for Chapter 7 typically takes 4 to 6 months, while Chapter 13 can last from 3 to 5 years, depending on the repayment plan.

Can I file for bankruptcy without an attorney?

Yes, you can file on your own, but due to the complexity of bankruptcy laws, it's recommended to seek legal assistance to ensure all procedures are correctly followed.

To actually file, either you or your attorney, will need to file a two-page petition and several other forms at your Arkansas district bankruptcy court.

United States Bankruptcy Court - Eastern & Western Districts of Arkansas - Chief Judge Phyllis M. Jones - Judge Richard D. Taylor - Judge Bianca M. Rucker ...

Bankruptcy cases cannot be filed in state court. Bankruptcy laws help people who can no longer pay their creditors get a fresh start by liquidating their assets ...

![]()